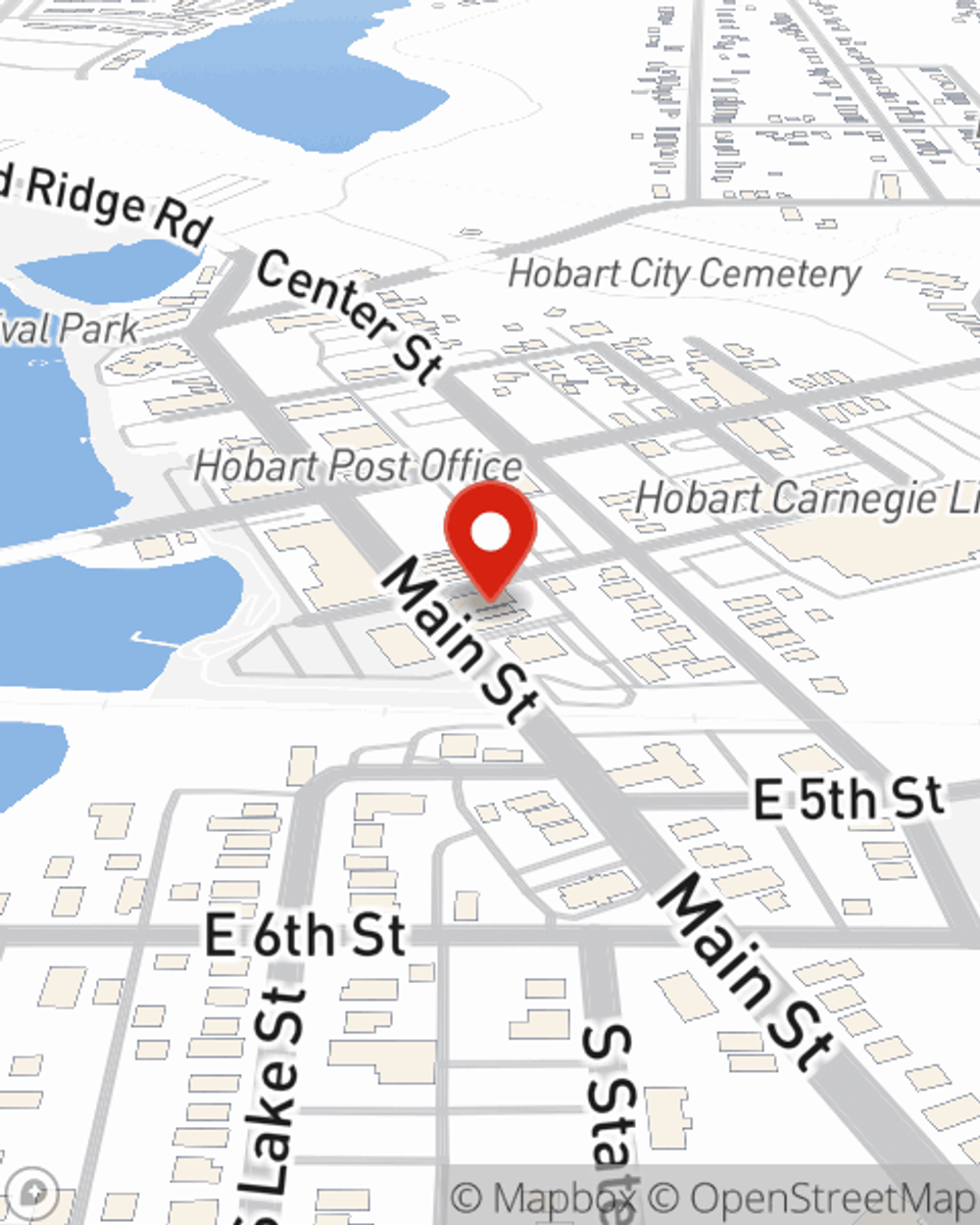

Business Insurance in and around Hobart

One of Hobart’s top choices for small business insurance.

Insure your business, intentionally

Help Protect Your Business With State Farm.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like business continuity plans, errors and omissions liability and extra liability coverage, you can feel confident that your small business is properly protected.

One of Hobart’s top choices for small business insurance.

Insure your business, intentionally

Protect Your Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent John Yelkich for a policy that safeguards your business. Your coverage can include everything from business continuity plans or errors and omissions liability to professional liability insurance or mobile property insurance.

Agent John Yelkich is here to explore your business insurance options with you. Reach out John Yelkich today!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

John Yelkich

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?