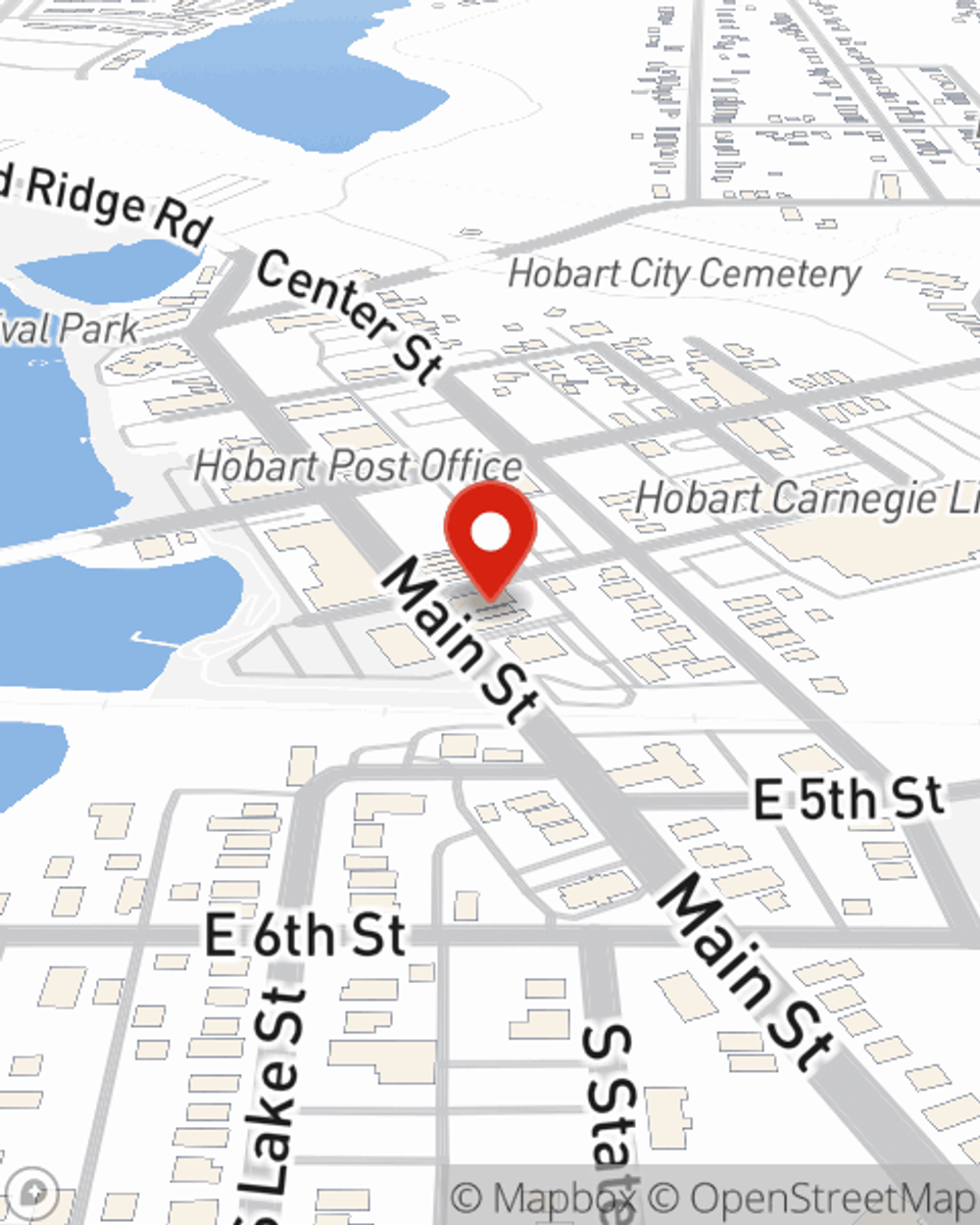

Renters Insurance in and around Hobart

Get renters insurance in Hobart

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Home is home even if you are leasing it. And whether it's a house or a condo, protection for your personal belongings is a good precaution, especially if you could not afford to replace lost or damaged possessions.

Get renters insurance in Hobart

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented apartment include a wide variety of things like your stereo, desk, TV, and more. That's why renters insurance can be such a good move. But don't worry, State Farm agent John Yelkich has the personal attention and experience needed to help you understand your coverage options and help you protect your belongings.

Get in touch with John Yelkich's office to find out the advantages of State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call John at (219) 940-3014 or visit our FAQ page.

Simple Insights®

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

John Yelkich

State Farm® Insurance AgentSimple Insights®

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.